5 key parts of security with Axiory

In Axiory, we provide more than just protection of client funds with segregated accounts. We integrate security in everything we do.

Our main goal is to offer balanced security for our customers, but at the same time we don’t limit customers by setting up strict leverage rules, FIFO, and more. Our vision was to create an easy and friendly environment where customers can feel trust from a brokerage and where customers are not limited to doing any kind of trading. The only way to achieve this was to choose a trustworthy regulatory environment and add safety features that show what real security means to us.

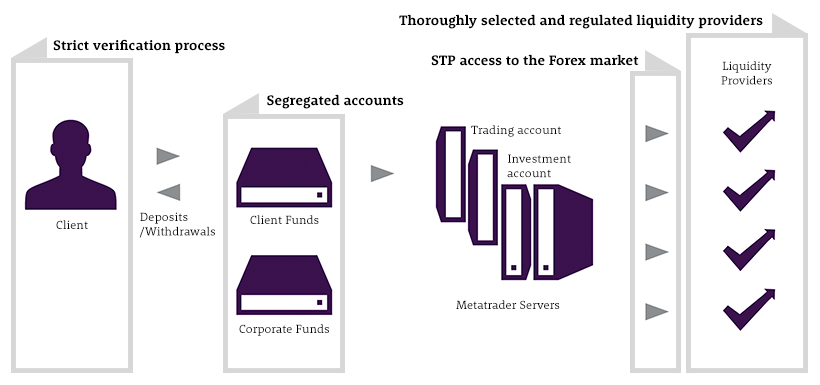

Regulated liquidity providers supply Axiory with an STP (Straight Through Processing) trading model that ranks among the fastest and most secure trading methods available.

All the clients’ deposits are held by reputable banks, which brings a high level of security of funds and fast processing of clients’ deposits and withdrawals.

Axiory abides by rigid client transfer procedures that ensure client accounts can only be funded by the account owner, and that funds can only be transferred with explicit authorization from the account owner.

All of this is supervised by the International Financial Services Commission (IFSC), a regulatory entity which oversees all the processes of Axiory.

Axiory is also a proud Member of The Financial Commission. The Financial Commission ensures that traders and brokers are getting their disputes resolved in a quick, efficient, unbiased, and authentic manner. New levels of security for customers includes a Compensation Fund.

Regulated liquidity providers supply Axiory with an STP (Straight Through Processing) trading model that ranks among the fastest and most secure trading methods available.

All the clients’ deposits are held by reputable banks, which brings a high level of security of funds and fast processing of clients’ deposits and withdrawals.

Axiory abides by rigid client transfer procedures that ensure client accounts can only be funded by the account owner, and that funds can only be transferred with explicit authorization from the account owner.

All of this is supervised by the International Financial Services Commission (IFSC), a regulatory entity which oversees all the processes of Axiory.

Axiory is also a proud Member of The Financial Commission. The Financial Commission ensures that traders and brokers are getting their disputes resolved in a quick, efficient, unbiased, and authentic manner. New levels of security for customers includes a Compensation Fund.

Funds segregation & execution model

Funds segregation

We decided to ask one of the most reputable auditing companies, PricewaterhouseCoopers (PWC), to audit our funds segregation.

We are required by IFSC rules to segregate clients’ money, but we do not feel that this is enough to show our commitment. Many brokers around the world, with even more famous regulators, have to segregate their funds but there is no guarantee that they actually do it.

By viewing the PWC report you can be 100% sure that the segregation in Axiory is in place.

No dealing desk model

ISRS 4400 by PwC

PwC has obtained schedule of assets and liabilities as of 30th June 2019 and found out that totals for individual balances are calculated properly and reconciled these amounts to the Company’s general ledger without difference. PwC also found in its report of factual findings that total assets were greater than total liabilities.

Certificate of regulation

The International Financial Services Commission regulator is an open minded regulator which does not limit trading conditions such as leverage and leaves this decision up to the clients. But on the other hand, in comparison with European regulations where companies use minimum capital starting at 125 000 EUR, IFSC requires up to 500 000 USD blocked capital that the broker can lose if it does not meet strict regulatory criteria.

Member of The Financial Commission

The Financial Commission ensures that traders and brokers are getting their disputes resolved in a quick, efficient, unbiased, and authentic manner, while making sure they walk away with a reliable answer, thus contributing to their overall knowledge about Forex.

As we strive to provide transparent and high quality service, we are proud to announce, that from November 1st, 2016 until this date, we had 0 complaints that were filed against Axiory Global with Financial Commission.

- Protection by the Commission’s Compensation Fund for up to €20,000 per case

- Access to a neutral and interest-free realm to address any complaint

- A swift and efficient investigation and resolution (as opposed to rigid and bureaucratic regulatory bodies).

Member of The Financial Commission

The Financial Commission was established as a neutral 3rd party committee to fairly review and resolve complaints in an effort to facilitate simpler, swifter resolution of disputes than is common through the industry’s regulators and the legal system. Besides that, The Commission also provides additional protection for traders by the use of The Commission’s Compensation Fund.

How does it work? The Compensation Fund acts as an insurance policy for members’ clients. This fund will be held in a separate bank account and only used should a member refuse to adhere to a judgment from the Financial Commission.

Start Here

Be where "human to human" approach is a reality

Try Demo AccountOpen Real AccountYour Capital is at Risk.